One of the best ways to save for college

Did you know that opening a regular savings account at your bank may not be your best option when it comes to saving for college? You can get tax breaks and other benefits by opening an investment account specifically designed to let you save for college.

Also known as qualified tuition programs, 529 college savings plans are administered by state agencies and organizations in 49 states and Washington, D.C. They’re designed specifically to help you save for future higher education expenses such as:

- Tuition

- Computers and technology

- Mandatory fees, books, supplies, and equipment required for enrollment or attendance

- Certain room and board costs during any academic period the beneficiary is enrolled at least half time

- Certain expenses for a special-needs student

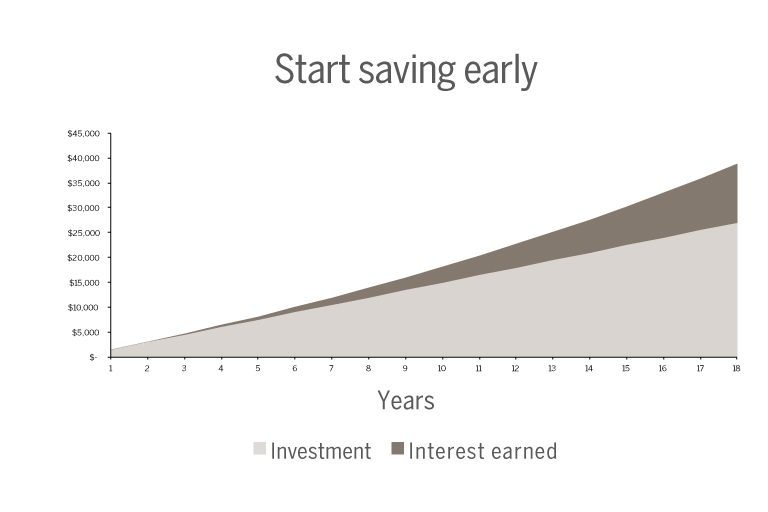

Save more now—pay less later

There’s no denying it—it’s cheaper to save for college than it is to borrow money for college. And the earlier you start, the more time your savings have to earn interest. The bottom line is that the more you plan and the more you save, the more options your child will have.

If you start saving now, you and your child may be able to:

- Take out fewer loans to pay for a college education

- Select the school that is the best for your child, with less emphasis on cost in the decision

- Experience less stress when the time comes to pay for college, knowing you’ve gotten a head start